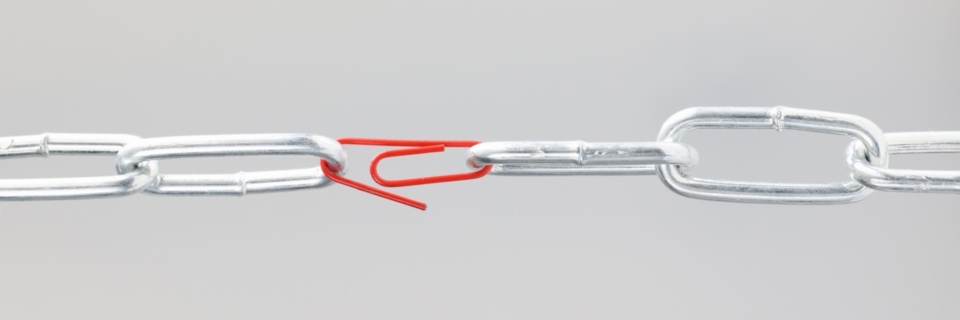

Red tape won’t make the world a better place

Posted on 27 Jan 2025

Not-for-profits should be focusing on what they want to do, which is to make Australia a better…

Posted on 16 Jul 2024

By Greg Thom, journalist, Institute of Community Directors Australia

The Australian Charities and Not-for-profits Commission (ACNC) has released a new tool designed to make charity registration and compliance easier.

The interactive online Charity Registration Check is designed to:

ACNC commissioner Sue Woodward said the new tool would help prospective charity applicants navigate the registration process.

“It provides tailored guidance and outlines necessary steps to identify potential issues before submitting a formal application to the ACNC,” she said.

The initiative comes as the regulator has been forced to manage a surge in registration applications from charities ahead of controversial reporting changes introduced by the Australian Tax Office.

From July 1, more than 150,000 non-charitable NFPs that self-assess as income tax exempt must comply with the strict new reporting regulations.

The ATO last year flagged changes requiring NFPs that have an ABN and are not registered with the ACNC to complete an annual self-review to assess their income tax exemption.

During a recent Senate Estimates hearing in Canberra, Ms Woodward indicated the ATO changes had prompted a sharp rise in the number of organisations applying for charity registration.

More than 1,115 organisations applied to be registered as charities in May, up from 651 during the same month last year.

“If you are a registered charity, you don’t have to do that [ATO] reporting,” said Ms Woodward.

“Correspondingly, people are now realising that they are eligible to be a charity and are therefore now applying.”

The ATO recently extended the deadline for lodging a self-review return by five months to March, 31, 2025.

“It [the Charity Registration Tool] provides tailored guidance and outlines necessary steps to identify potential issues before submitting a formal application to the ACNC.”

According to the ACNC website, the new charity registration tool asks specific questions about an organisation’s circumstances and provides tailored responses.

Based on these responses, it then outlines the next steps that need to be taken, helping users understand the charity registration criteria and the information they need to provide to make a successful registration application, or to maintain eligibility to be registered.

New applicants can use the tool to identify potential issues before submitting a formal registration application to the regulator.

Registered charities can use it to check they are continuing to meet all requirements to maintain their registration, such as keeping Responsible Persons' names up to date if there has been a new board appointment.

The ACNC said charities may also be asked to use the new tool to self-assess ongoing entitlement when the regulator conducts annual reviews of deductible gift recipient (DGR) eligibility.

Posted on 27 Jan 2025

Not-for-profits should be focusing on what they want to do, which is to make Australia a better…

Posted on 21 Jan 2025

Australia’s financial reporting framework for charities has been labelled “outdated” and badly in…

Posted on 13 Jan 2025

The Smith Family CEO Doug Taylor shares some thoughts on ways sector leaders can make a bigger…

Posted on 10 Dec 2024

Corporate and philanthropic organisations are increasingly engaging women and girls to help…

Posted on 05 Dec 2024

The federal government will scrap the $2 minimum for tax deductible donations.

Posted on 28 Nov 2024

Just one in three not-for-profit organisations have effective processes in place to manage…

Posted on 27 Nov 2024

The introduction of a system to quantify and better manage the actual cost of delivering frontline…

Posted on 26 Nov 2024

As the philanthropic sector waits for the federal government to respond to the Productivity…

Posted on 19 Nov 2024

An increasingly fractious global environment combined with domestic cost-of-living pressures has…

Posted on 12 Nov 2024

The Australian Taxation Office (ATO) has launched a new online and social media advertising blitz…

Posted on 12 Nov 2024

An Australian investment firm with a strong philanthropic focus is seeking new not-for-profit…

Posted on 04 Nov 2024

The number of concerns raised with the Australian Charities and Not-for-profits Commission (ACNC)…